Small Loans

Delivered Fast

When life throws you a curveball, you might need some help paying for it.

A Personal Loan with Jacaranda Finance could be just what you need to manage these unexpected (and expected) expenses.

Check If You Qualify

With no impact on your credit score!

Check If You Qualify with no impact on your credit score!

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

When life throws you a curveball, you might need some help paying for it.

A Personal Loan with Jacaranda Finance could be just what you need to manage these unexpected (and expected) expenses.

Why get a Small Loan with Jacaranda?

We make borrowing a breeze. Focusing on efficiency and quick responses, your financial needs are our top priority.

The quick loan application process

We know how important it is to receive your funds in a timely manner. As a hard-working Australian, you don't have time to waste on needless paperwork.

That's why our loan application process has been perfected over time to be as simple and quick as possible.

How to apply for a Personal Loan with Jacaranda

Apply online today in just four simple steps:

- Apply in just 5-12 minutes1, depending on your circumstances

- Check if you qualify without impacting your credit score

- Receive a same-day outcome on your loan application

- If approved, get your money within 60 seconds

Estimate Your Loan Repayments

Use our loan repayment calculator to gauge what your repayments could be.

Ready to Apply? You can get started now.

Including Interest & Fees

Loan Cost Details

Jacaranda's Small Loans are designed to be fast, fair, and, above all, affordable, with no hidden fees.

Discover the finer details from the table below. Visit our rates and fees page for more information.

Loan Eligibility Criteria

- Be at least 19 years of age

- Be employed on a permanent or casual basis, with consistent income for 90 days

- Be an Australian citizen or permanent resident with a fixed address.

- Have an active email address, phone number, & online banking details in your name.

- Be in control of your current finances and handling existing financial commitments comfortably.

You can check if you qualify initially if you aren’t sure whether you're eligible. This won’t impact your credit score.

Information you will need to provide:

- Basic personal information (i.e. full name, address, D.O.B, number of dependants etc.)

- Employment status & details

- Your bank statements*: we will assess the last 12 months of your bank statements to help determine if you can afford to repay your loan.

*This is standard procedure for loan applications across the industry. Data is safely secured with 256-bit SSL encryption. We utilise safe and secure third-party Open Banking service providers to make this quick and easy for you.

It’s Faster With the Better Credit App

- Easily apply for and manage your loan in-app

- Make extra repayments, check your balance & more

- Easy access to our customer service team

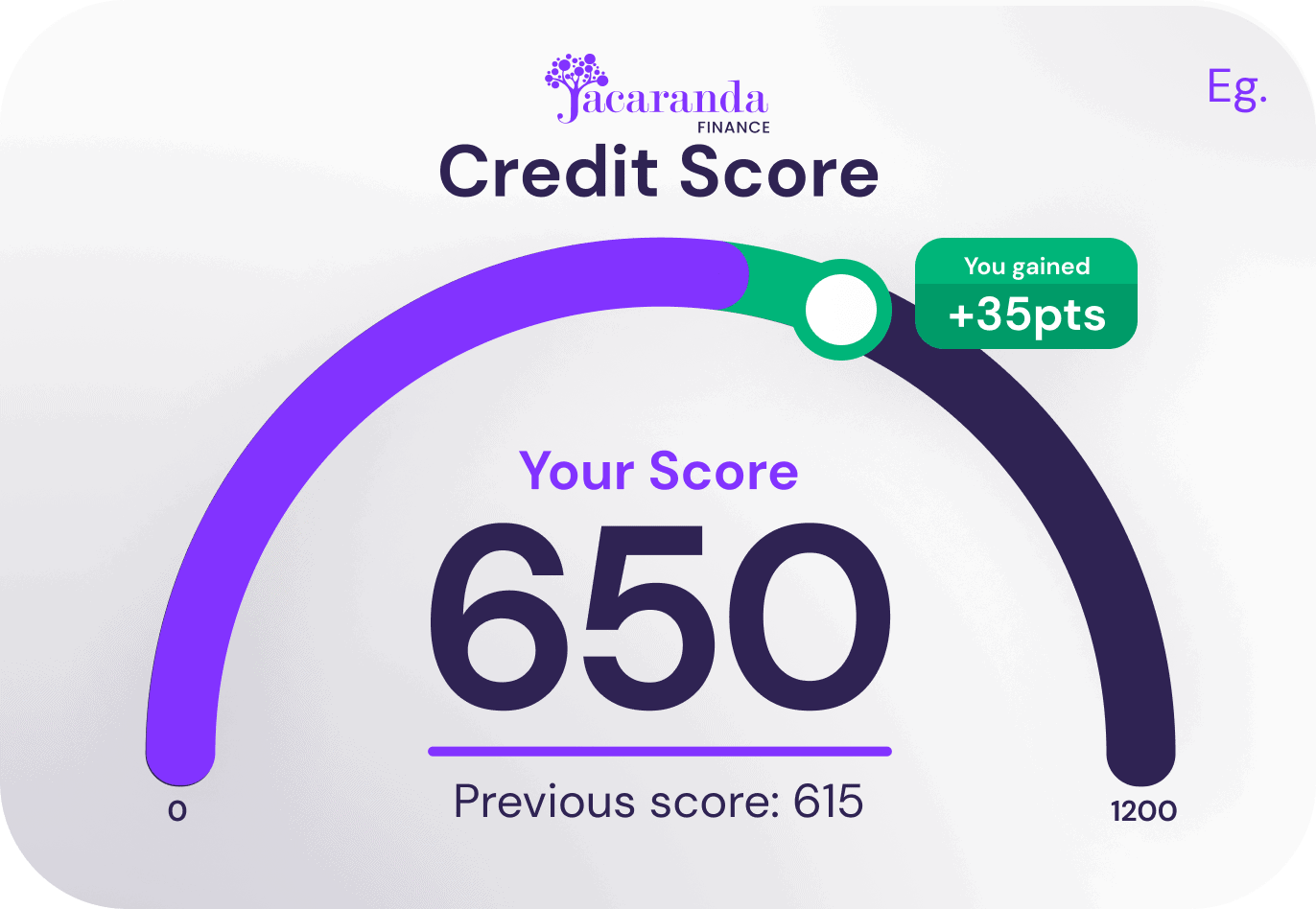

- Check your credit score

New!

Boost Your Credit Score With Jacaranda

Worried about being denied a loan? No stress! At Jacaranda, QualifyCheck lets you check if you qualify without affecting your credit score!

Making all your repayments to us on time could steadily improve your credit score and positively impact your ability to get credit in the future.

Trusted by 1,000s

FAQs

Learn more about how our loans work with answers to our most common questions.

In Australia, a small loan is a loan taken out to cover small- to medium-sized expenses. These loans allow you to borrow a lump sum to be repaid with interest over a specified loan term.

At Jacaranda Finance, our Personal Loan could be the small loan solution you need to manage those smaller but still significant expenses.

With our Personal Loan, you can borrow as little as $3,000, with loan terms starting from 25 months.

Fixed interest rates mean you can pay your loan off in a shorter period of time with more structured repayments, and you can pay extra if you want at no additional cost!

Whether you want to pay for flights, car repairs, or moving expenses upfront, a Jacaranda Personal Loan could be what you're looking for.

No. Payday loans typically offer amounts up to $2,000, with loan terms starting from 16 days to one year, which tend to be more expensive overall.

Jacaranda's small loans, on the other hand, start from $3,000 up to $25,000, with minimum loan terms of 25 months. Visit short-term loans for more information.

We review all applications, even those who have bad credit.

Before you formally apply with Jacaranda, you can check if you qualify for a loan in a way that does not impact your credit score. We do this by performing a 'soft' credit check that is only visible to you.If you don't meet our initial criteria, your credit score won't be affected.

Once you've checked your eligibility and we've let you know that you do qualify for a loan, you have the option to move forward with a full application.

We will perform a credit assessment during this process, which involves checking your credit report. By submitting a full application, you authorise Jacaranda Finance to obtain a copy of your full credit file, referred to as a 'hard' credit check.

Other lenders will be able to see that you applied for a loan with Jacaranda.

This might impact your credit score.

Review our Privacy Policy for more information.Our loan application process has been designed to be as simple and quick as possible, as we know how important it is to receive your funds in a timely manner. How quickly you can apply for a personal loan and receive your funds will depend on your situation.

Applying for a loan with Jacaranda Finance takes most people 5-12 minutes1, but it could take longer depending on a number of factors such as but not limited to how fast you are at typing or if you have all the required information on hand.

After applying, most customers get an outcome on their loan application on the same day during normal business hours once we have received all of the supporting information we require. We do not guarantee same-day outcomes for all customers.2

Once an applicant has been approved and they have signed a contract, we automatically attempt to release the money to the applicant's bank account. Most customers have a New Payments Platform (NPP) bank account and receive the money in their bank account within 60 seconds. For other customers, the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.3

Repayments on your loan are automatically set up to be deducted via direct debit from your bank account in line with your pay cycle.

You can view your repayments from either the Better Credit app or online portal and contact our friendly customer service team to request any changes that you need.

Download the app on the Google or Apple store today.

Read more: Personal Loan Repayments 101.

What else can I use a Small Loan for?

Related Articles

Check out our latest articles covering all kinds of topics. From emergency cash and small personal loans to credit checks and comparison rates, explore our tips for every financial situation.

Get in Touch

Whether you're a new customer or an existing one – our friendly customer service team is here to help.